Anadarko's Eagle Ford production is up 55% from one year ago to 42,200 boe/d. Liquids volumes account for 28,000 b/d of production and grew even faster at a rate of 60% over the past year.

Anadarko drilled 70 Eagle Ford wells in the quarter with an average of eight rigs working. Drilling times continue to fall and many of the company's wells are now drilled in less than 10 days. Completion costs are coming down as well and the company is spending an average of $5.5-6 million per well.

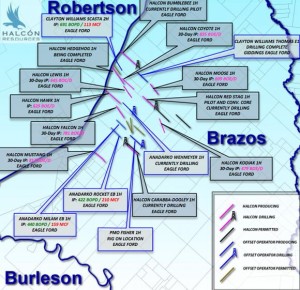

Charles Meloy, Senior VP, stated "We are in the middle of doing tie-ins to the Brasada plant, and so we will have quite a bit of downtime associated in our Eagle Ford production area as we tie in the Brasada plant and the associated facilities in the field."

The company is bringing 200 mmcf/d of processing capacity online in the second quarter. The Brasada Plant is just south of Cotulla in La Salle County, TX, and will be completed in late May or early June. Anadarko has spent $100 million to build the plant and will increase its liquids yield even more when the plant comes online.

Read the full first quarter press release at anadarko.com