Newfield Exploration Company

Newfield has operated in the Maverick Basin of South Texas since its acquisition of TXCO Resources' acreage in 2010. Eagle Ford operations are relatively centralized in Dimmit, Maverick, and Zavala counties, but the company also has acreage in Atascosa County. The Eagle Ford Shale produces varying amounts of gas, condensate and oil as you move north through Newfield's acreage. The southern portion of the company's acreage produces gas with associated condensate, where the company's northern acreage in Maverick County produces a heavy crude with as low as a 30 degree API. While Newfield operated in South Texas previous to the Eagle Ford's discovery, the company established a core operating area when it entered the Maverick Basin through the acquisition TXCO Resources' acreage in January 2010. Newfield, along with Anadarko Petroleum, completed a joint transaction where the two companies took over TXCO Resources Maverick Basin Eagle Ford Shale assets. Newfield acquired more than 350,000 gross acres (300,000 net acres) for approximately $217 million. The assets were producing 1,500 beopd at the time of the announcement and not all acreage is prospective for the Eagle Ford.

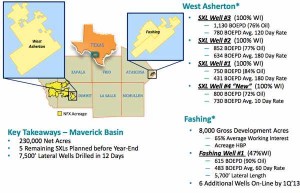

Newfield has approximately 230,000 net acres targeting the Eagle Ford and developing the play in the Maverick basin with laterals of 7,500 ft, which can be drilled in as little as 12 days. In the West Asherton Area, the company drills laterals as long as 10,000 ft and has drive well costs down to almost $7 million for the typical 7,500 ft lateral.

Newfield Exploration (NYSE: NFX) is an independent crude oil and natural gas exploration and production company.. The company headquarters is in Houston, TX. The company has South Texas offices in Premont, TX, and in Karnes City, TX. Joe B. Foster, former Chairman of Tenneco Oil Company, founded Newfield in 1988 with $9 million. The core areas of operations include the Anadarko and Arkoma Basins of the Mid-Continent, the Uinta Basin in the Rocky Mountains, onshore Texas and the Gulf of Mexico. The company also operates offshore Malaysia and China.

Eagle Ford Shale Oil & Gas Discussion Forum

Join the Eagle Ford Discussion Group today - your voice counts!

Mineral Rights Forum is a discussion network for mineral owners, royalty owners and industry professionals to discuss oil & gas related topics.

Counties Where Newfield Exploration is Active

Newfield Exploration Eagle Ford Shale Quarterly Commentary

February 2016

For the full year of 2015, Newfield's production in the Eagle Ford was 4.1 Mmboe. For 2016, the company plans to invest solely through the outside-operated program in the Fashing area, and this constitutes about $28 million or 5% of all spending.

April 29, 2014

Eagle Ford net production in the first quarter of 2014 was nearly 11,000 boe/d. The company is running a single-rig program to develop its West Asherton field and Fashing area.

Production is expected to maintain current levels throughout 2014 and grow approximately 30% year-over-year. Newfield expects to drill about 20 wells during 2014. Current 7,500' lateral well costs are averaging approximately $6.7 million, including artificial lift and facilities costs.

November 4, 2013

Average third quarter net production in the Eagle Ford was up 9% quarter-over-quarter to 8,200 boe/d.

Fourth quarter 2013 net production in the Eagle Ford is expected to average 12,200 boe/d, reflecting the completion of new pads in the Company's West Asherton development.

Average drilling and completion costs for 7,500' lateral wells in the Eagle Ford year-to-date are $7.3 million gross, down more than 20% year-over-year. The Company's full-year 2013 Eagle Ford production is expected to increase about 70% over 2012.

July 24, 2013

Average net production in the Eagle Ford was 7,500 boe/d, slightly above guidance for the quarter.

Six new operated super-extended-lateral (SXL) wells were completed in the second quarter. Newfield's net Eagle Ford production is expected to increase 13% quarter-over-quarter in the third quarter of 2013 with 16 new SXL well completions planned.

Drilling and completion costs in the Eagle Ford are down 18% year-to-date compared to 2012 averages. Second quarter 2013 completed well costs averaged $7.5 million.

The Company's full-year 2013 Eagle Ford production is expected to increase more than 75% over 2012.

April 23, 2013

Drilled six additional super extended lateral wells in the Eagle Ford Shale with well costs lowered by $0.4 million over 2012 average completed well costs.

Wells are in various stages of completion with a 45% increase in quarter-over-quarter Eagle Ford production expected in the second quarter of 2013.

February 19, 2013

Newfield plans to invest approximately $275 million in its Eagle Ford drilling program in 2013 and expects to drill 35 wells. Active development drilling is currently underway in its West Asherton field.

Super-extended-lateral (SXL) wells are being drilled cost effectively from common pad locations. To date, Newfield has drilled and completed four successful SXL wells with lateral lengths of approximately 7,500' in Dimmit County. Newfield has a 100% working interest in all of the SXL wells. Recent SXLs are being drilled and cased in as few as 12 days.

The SXL wells have average initial gross production rates of 800 boe/d (75% liquids) under controlled flowback. After monitoring production from the SXL wells for as much as 300 days, the Company estimates that their EURs are more than 500,000 boe. Three of the wells have more than 180 days and have averaged 590 boe/d gross over that period. Newfield recently completed its first 10,000 ft SXL in Dimmit County which has been online for 90 days with average production of 917 boe/d and a peak rate of more than 1,200 boe/d.

In Atascosa County, Texas, the Company has an average 65% working interest in approximately 8,000 gross operated and outside-operated acres, which are held by production. A six-well drilling campaign was conducted in the second half of 2012. Current gross production is facility limited at approximately 2,000 BOEPD.

October 24, 2012

Year-to-date, Newfield has drilled and completed four successful extended lateral wells (SXL) wells with lateral lengths of approximately 7,500' in Dimmit County. The most recent well was drilled and cased for $3 million and the company plans to target total well costs of $8 million once pad drilling starts. That should yield internal rates of return in excess of 50%. For that reason alone, the company is increasing activity in 2013 and will drill as many as 35 wells across its acreage.

The four SXL wells had average initial gross production rates ranging from 750 BOEPD to 1,020 BOEPD gross (approximately 75% oil). Two of the wells have been on-line for more than 180 days and have averaged 530 BOEPD gross. A third well has been on-line for 120 days, averaging approximately 800 BOEPD gross. Most recently, a fourth SXL well was completed and turned to sales. Over a 10-day period, the well has averaged 730 BOEPD gross. Newfield is currently completing its first 10,000' lateral in Dimmit County. SXL wells are expected to have EURs of more than 500,000 BOE

In the company's Fashing area in Atascosa County, Texas, the Company has an avg 65% working interest in approximately 8,000 gross operated and outside-operated acres, which are held by production. The first well drilled in the area recently commenced production with an initial gross production rate of 615 BOEPD and average gross production of 483 BOEPD over 60 days. Six additional wells are expected to be online in early 2013.

July 19, 2012

In all of Newfield's wet gas condensate and oil assessment plays, the Company is employing "controlled flowback" in its completion practices. This includes news releases from the Cana Woodford, Uinta Basin, Eagle Ford Shale and Williston Basin. Through this practice, initial production rates are being intentionally held back to minimize pressure drawdown, maintain higher reservoir pressure and maximize oil recovery over time.

Newfield has approximately 230,000 net acres in the Maverick Basin of Texas and has been active in Maverick, Zavala and Dimmit counties since 2010. In early 2012, Newfield commenced a program to test SXLs on its Eagle Ford acreage.

Year-to-date, Newfield has drilled three successful SXL wells with lateral lengths of approximately 7,500' in Dimmit County. The three SXL wells had average initial gross production rates ranging from 750 BOEPD to 1,020 BOEPD gross. Two of the three wells have been on-line for at least 90 days with average production per well of 600 BOEPD gross for the period. Newfield has a 100% working interest in these wells.

Based on production data to date, Newfield estimates the SXL wells have a gross EUR of more than 500 MBOE. Newfield has approximately 40,000 net acres under assessment and development in the Eagle Ford. Six additional SXL wells are planned for the second half of this year, including a 10,000' lateral.

In addition, Newfield is participating in an outside-operated Eagle Ford program in Atascosa County, Texas, where the Company has an average 65% working interest in approximately 8,000 gross acres which are held by production. Two wells have been drilled to date and are in various stages of completion. Additional drilling is planned in the second half of 2012.

Drilling efficiencies are evident in the Company's Eagle Ford operations, with the recent SXLs being drilled and cased in as few as 12 days. Newfield estimates that SXL wells can be drilled and completed for approximately $8 million gross.

Current net production from the Company's Onshore Gulf Coast area is more than 15,000 BOEPD.

April 25, 2012

We have seen encouraging results from our first 2 extended lateral wells, or SXLs, in the Eagle Ford Shale play. We have 2 additional SXL wells underway today, and expect to drill more than 1/3 of our Eagle Ford wells this year as SXLs.

Consistent with our past practices in disclosure of well results, I will not release IP rates from 1 or 2 wells in isolation. As we have promised, we'll have an update on multiple plays around mid-year 2012. By then, we'll have results from up to 4 super extended lateral wells in the Eagle Ford; multiple wells in the Uinta Basin, including our first 2 pressured horizontal Uteland Butte wells and our first 2 horizontal Wasatch wells. We'll also have early results from our initial drilling in oil and liquids rich portion of the Cana Woodford. Our early results in these areas are encouraging, and we'll have a meaningful update for you around mid-year.

October 19, 2011

Newfield continues to explore and assess its 335,000 net acre position in the Maverick Basin of South Texas. Recent drilling activity in the Eagle Ford Shale has focused on the "southern" portion of the Company's acreage along existing infrastructure. A pilot program in the West Asherton area (Dimmitt County, Texas) is underway with recent wells being drilled from pad locations to help determine optimal development spacing. To date, Newfield has completed 16 wells in West Asherton with average 24-hour gross initial production of 650 BOEPD. Estimated ultimate recovery from these wells is approximately 300 MBOE. The wells have been drilled in as few as seven days and gross completed well costs have averaged approximately $6.6 million.

Year-to-date, the Company has completed 24 wells in the Eagle Ford Shale, six wells in the Georgetown formation and two wells in the Pearsall Shale. Current gross production from the Maverick Basin is approximately 7,000 BOEPD. Newfield's average working interest in the region is approximately 80%.

July 20, 2011

“Eagle Ford Shale - Newfield continues to explore and assess its 335,000 net acre position in the Maverick Basin. Oil field services in the region today remain tight. The Company expects that it can meet its contractual drilling obligations and hold its leases by running one to two rigs in the play through the remainder of 2011. By limiting activity to this level, capital can be redirected to the Uinta Basin where the Company is adding operated rigs. We continue to assess and increase our understanding of the Eagle Ford Shale, as well as other prospective formations including the Georgetown and Pearsall.Year-to-date, the Company has completed 13 wells in the Eagle Ford Shale, four wells in the Georgetown formation and two wells in the Pearsall Shale. Current gross production from the Maverick Basin is approximately 6,500 BOEPD. Newfield's average working interest in the region is approximately 80%.Recent drilling activity in the Eagle Ford has focused on the "southern" portion of the Company's acreage. An area up to 50,000 acres is now being developed along existing infrastructure. A pilot program is underway with recent wells being drilled from pad locations to help determine optimal well spacing. The wells have been drilled in as few as seven days and gross completed well costs have averaged approximately $6.6 million. Initial 24-hour gross production rates from recent wells have ranged from 400 - 1,400 BOEPD.”

April 20, 2011

“Eagle Ford Shale - Newfield is running 2 -3 operated rigs and continues to assess its 335,000 net acre position in the Maverick Basin (approximate 85% working interest). Drilling and completion operations in the basin ceased in October 2010 due to seasonal hunting stipulations. Activities resumed in February 2011. Contracted fracture stimulation services are in the field and five wells have been drilled and are planned for completion in the second quarter of 2011.

Recent wells have lateral lengths of approximately 5,000' and are averaging less than days to drill and case. Efficiency gains in drilling have reduced drill and case costs to less than $2 million (gross) per well. Completion services remain tight throughout the Eagle Ford Shale and are averaging $4.5 - $5.0 million (gross) per well.”