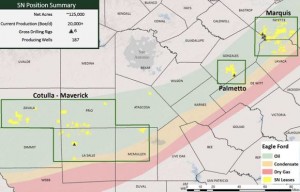

Doggett acquired truck dealerships in Laredo, McAllen, and San Antonio in December. The deals create a network of dealerships that span the region and expand the company's influence in the South Texas Eagle Ford oil boom.

Doggett spent $30 million to acquire three Freightliner and one Western Star Trucking dealership.

Doggett Trucking Group acquired the dealerships from Opus Kane Truck Group and one from Eddy Vaughn Freightliner.

Prior to the deals, the company had almost 25 dealerships selling John Deere and Toyota Industrial Equipment across the Gulf Coast region.

Booming Trucking Industry in South Texas

The acquisitions complement the company's John Deere and Toyota Industrial Equipment dealerships across the region. Doggett has seen the equipment boom first hand and knows the trucking industry is flourishing as well.

Trucks are used to move equipment, supply oilfield development, move operational fluids, and transport oil. On this site alone, we've seen dozens of open driving jobs and thousands of applicants. The trucking industry has probably brought thousands of people to South Texas on its own. It's no surprise the company sees this portion of the industry as an area of growth.

The acquisition does just provide sales centers. The locations also provide additional service centers. It will be interesting to see if the dealerships acquired begin to offer services for the equipment Doggett sells as well.

Read more about the Doggett deals at Fuelfix.com