To say Karnes City has changed over the past few years is an understatement. The Houston Chronicle conducted an interview with a local farmer who owns the land where ConocoPhillips drilled its first Eagle Ford well.

Change started with the growth in oilfield jobs and booming royalty checks. Today, cash is being poured into the area.

"It's been good to me. I miss that pasture, but I could have ranched here for 300 years and not have the income we do now," he said. "Anyone who owns property should be benefiting."

A few takeaways:

- Karnes City was once the poorest non-border town in the state

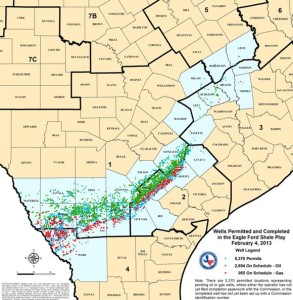

- 1,200 permits have been issued in the county over the past four years

- 2,000 miles of pipe have been laid

- As much as $70 million/month is being paid to royalty owners in the county

- Traffic counts are up as much as 300% on local roads

- County's tax base has jumped from $562 million to $3.1 billion in 3 short years

"A kid can leave a $40,000 overtime job at the prison and make over $100,000 in the oil field. You've got kids coming home to work here who haven't lived here in a long time," he said.

Read the full article at chron.com