Pioneer Natural Resources' (PXD) Eagle Ford drilling will come from centralized pads 80% of the time in 2013. That's up from 45% of the time in 2012 and will allow the company to drill 130 wells with just 10 rigs. Pioneer saves $600,00-700,000 per well when utilizing pads. Approximately 130 wells were drilled in 2012 with an average of 12 rigs running.

Pioneer plans to spend $575 million of its $3 billion 2013 capital budget in the Eagle Ford.

“Pioneer plans to spend $575 million of its $3 billion 2013 capital budget in the Eagle Ford.”

Pioneer will be using the savings from pad drilling to extend the lateral reach of its average well. Horizontal laterals averaged 5,700 ft in 2012, but PXD will be targeting 6,200 ft in 2013. The extra 500 ft of reservoir contact will cost about $500,000 to drill and complete. In general, longer laterals decrease the number of wells needed over the life of the play.

White sand completions will be tested in deeper areas of the Eagle Ford in 2013. PXD has been monitoring the use of white sand completions in shallow wells for the past two years and is now confident enough to test the practice in deeper areas with higher pressures. To date, the company has test 97 wells completed with white sand and has saved an average of $700,000 per well.

PXD has 11 central gathering plants in place and expects to bring one more online in late 2013.

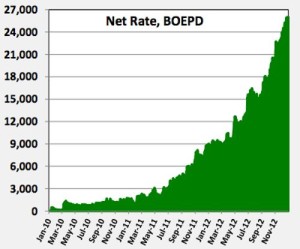

Production grew from an average of 12 mboe/d in 2011 to 28 mboe/d in 2012. In 2013, the company has issued guidance of 38-42 mboe/d.