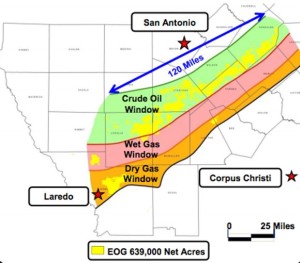

EOG Resources completed a well in Atascosa County that produced over 2,800 b/d of oil, 160 b/d of NGLs, and almost 1 mmcfd. The well is a record for EOG's Western Eagle Ford acreage.

The company also had wells in La Salle and McMullen counties that produced ~2,000 b/d or more during the third quarter.

Recent results prove new completion methods bring the Western Eagle Ford up to par with the company's prolific acreage to the east.

“EOG is consistently making the best oil wells in the best two oil plays in North America, the Eagle Ford and Bakken/Three Forks.”

EOG is running 25 rigs in the Eagle Ford, with 9 of those running in the western portion of the company's acreage.

EOG Eagle Ford Well Highlights

- Kaiser Junior Unit #1H in Atascosa County produced 2,815 b/d of oil, 160 b/d of NGLs, and 940 mcf/d

- Three wells in La Salle County came online producing oil at rates of 1,960-2,810 b/d

- Five wells in McMullen County came online producing oil at rates of 1,970-2,115 b/d

- Over 20% of the company's wells in the eastern portion of the play produced more than 2,500 b/d

"Because we now are achieving high growth, high rate-of-return results from our western acreage, we have effectively raised the bar for all of EOG's Eagle Ford acreage," Thomas said.

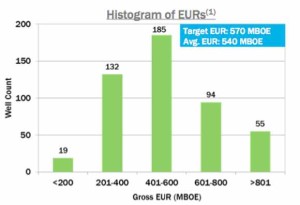

EOG Increases Company-wide Production Growth Estimates

Production guidance in 2013 has been increased again. EOG expects 39% growth in oil production, 17% growth in NGL production and company-wide growth of 9%. That's up from initial estimates of 28% crude oil growth, 10% NGL growth, and just 4% company-wide growth at the beginning of the year.