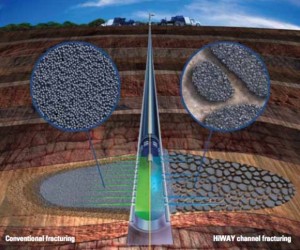

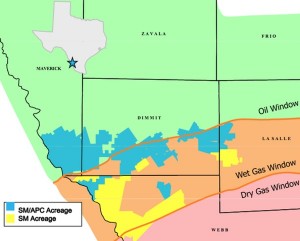

Schlumberger's (SLB) HiWay flow channel frack design has been most successful in the Eagle Ford. The company has completed a significant number of wells in the basin and has shown the design increases production while utilizing less proppant.

The production response has not been as positive in other plays, but the company generally sees flat to higher production with lower well costs. The advantage where production isn't higher is the cost savings realized by using 40% less sand/proppant.

Paal Kibsgaard, CEO, stated "We believe its (HiWay Frac's) applicable in every basin"

Also read: Forest - Schlumberger JV Allows Forest to Drill More With Less

Record North American Revenue

Schlumberger reported strong results in the third quarter. The company's North American revenue was up 7% and set an all time high at $3.6 billion.

The company did see downward pricing pressure, but less than it has experienced in prior quarters.

Schlumberger also discussed ongoing tests to increase the utilization of perforation clusters in completions. Prior tests have shown that 30-70% of perforation clusters do not contribute to production. The company is testing a diversion technology that is employed during the completion. Watch for future announcements from Schlumberger and other oilfield service providers.

If possible, it's in everyone's best interest to increase well performance by 30-70%.