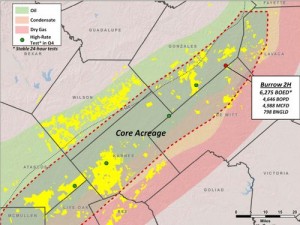

Marathon Oil announced three significant items on September 10th. The company plans to repurchase $1 billion in common stock, sell an interest in Angola for $590 million, and complete an acquisition of 4,800 acres in the Eagle Ford for $97 million.

The company didn't release much in regard to the acquisition, but it's safe to assume the acreage will complement the company's current position. Marathon is paying $74 million upfront and $23 million in the form of carried interests.

“We continue to evaluate our portfolio for high-grading opportunities and expect that process to remain evergreen and integral to our forward business plans.”

On an undiscounted basis, the company is paying a little more than $20,000/acre. The deal brings Marathon's core Eagle Ford position up to approximately 205,000 net acres.

When Marathon first entered the Eagle Ford, the company estimated development on 80 to 160-acre spacing. So far in 2013, approximately 80% of the company's development drilling has occurred on 40 to 60-acre spacing.

Read the full press release at marathonoil.com